The North America aromatic compounds market share reached a substantial size of USD 55.2 billion in 2023. With a projected compound annual growth rate (CAGR) of 4.7% from 2024 to 2032, the market is expected to expand to nearly USD 83.8 billion by 2032. Aromatic compounds, vital in numerous industries, especially in chemicals, pharmaceuticals, and petrochemicals, are a critical component of Chemicals and Materials and fall under the subcategory of Specialty and Fine Chemicals. This article delves into the market's growth drivers, key benefits, recent industry developments, COVID-19 impact, restraining factors, segmentation, trends, regional insights, major players, and future opportunities.

Market Overview and Key Benefits

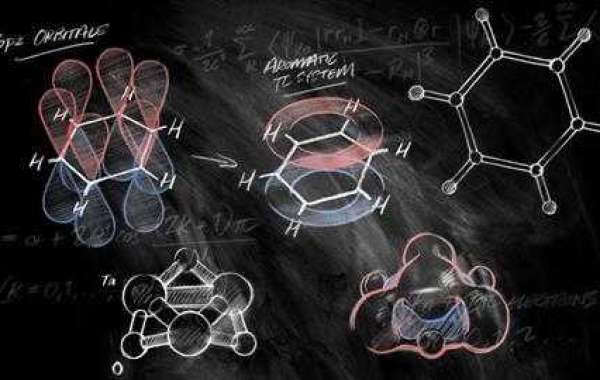

Aromatic compounds are organic molecules containing benzene rings, known for their unique stability and chemical properties. They serve as crucial building blocks in the production of plastics, dyes, paints, pharmaceuticals, and other high-value materials. The key benefits of aromatic compounds include their versatile chemical properties, which make them essential in producing durable, efficient, and high-quality materials. Industries across North America rely on these compounds to enhance product performance and develop specialized chemicals. The growth in demand for petrochemicals, solvents, and adhesives further underscores the importance of aromatic compounds in the region's manufacturing landscape.

Key Industry Developments

The aromatic compounds market in North America has experienced several advancements and strategic moves by key players. Many companies are investing in new production facilities and focusing on sustainable technologies to reduce environmental impact. For example, recent developments in bio-based benzene production reflect the industry's push toward greener alternatives. Partnerships between chemical manufacturers and technology providers are also expanding, fostering innovation in the synthesis and application of aromatic compounds. Additionally, industry players are enhancing their focus on safety standards and regulatory compliance, particularly in response to stricter environmental guidelines.

Driving Factors

High Demand in Petrochemical and Plastic Industries: The petrochemical and plastic industries are among the largest consumers of aromatic compounds, using them to produce polymers, resins, and other materials. As these industries continue to grow, they drive significant demand for aromatic compounds.

Growth in Pharmaceuticals and Healthcare: Aromatic compounds serve as essential ingredients in pharmaceuticals, particularly in active pharmaceutical ingredients (APIs). The ongoing expansion of the healthcare industry in North America increases the need for these compounds in drug development.

Rising Demand for Specialty and Fine Chemicals: Specialty and fine chemicals derived from aromatic compounds are increasingly used in adhesives, paints, dyes, and coatings. These applications support demand as industries seek compounds that enhance durability and performance.

Focus on Sustainable Production Processes: As environmental concerns rise, the industry is focusing on eco-friendly production processes, such as bio-based benzene and renewable sources, which appeal to environmentally conscious companies and consumers.

COVID-19 Impact

The COVID-19 pandemic impacted the North America aromatic compounds market by disrupting supply chains and affecting production in various industries. Lockdowns and restrictions initially reduced demand in the automotive, construction, and manufacturing sectors. However, the healthcare and pharmaceutical sectors witnessed heightened demand for aromatic compounds used in drug production. As industries adapted, the market rebounded, with an emphasis on diversifying supply chains and ensuring resilience against future disruptions. The pandemic also accelerated the push for sustainable practices, as companies in the chemical sector explored greener production methods to address long-term environmental goals.

Restraining Factors

Strict Environmental Regulations: Aromatic compounds, particularly benzene, toluene, and xylene, are classified as hazardous pollutants. Stringent regulations governing emissions and handling create challenges for manufacturers and increase compliance costs.

Volatile Raw Material Prices: The price of crude oil, a primary feedstock for aromatic compounds, is subject to fluctuations that affect production costs and profit margins for manufacturers.

Health Risks and Safety Concerns: Due to the potential health risks associated with prolonged exposure, aromatic compounds face scrutiny from regulatory bodies, affecting their market adoption in certain applications.

Market Segmentation

By Type:

- Benzene

- Toluene

- Xylene

- Others (e.g., styrene, phenol)

By Application:

- Pharmaceuticals

- Plastics and Resins

- Paints and Coatings

- Adhesives

- Chemicals and Solvents

- Dyes and Pigments

By End-Use Industry:

- Petrochemical

- Healthcare and Pharmaceuticals

- Automotive

- Construction

- Consumer Goods

Market Trends

Shift Towards Bio-Based and Renewable Aromatics: There is a growing trend toward bio-based and renewable aromatic compounds, driven by environmental concerns and regulatory pressures. Innovations in bio-based benzene and renewable aromatic production are gaining traction as companies seek sustainable alternatives.

Expansion in Specialty Applications: The demand for specialty chemicals derived from aromatic compounds is rising, particularly in the adhesives, paints, and coatings sectors. These compounds provide durability, flexibility, and enhanced performance, making them essential in high-value applications.

Advances in Production Technology: Technological advancements in production processes, such as catalytic reforming and hydrodealkylation, are enhancing the efficiency of aromatic compound synthesis. These developments reduce production costs and environmental impact, benefiting both manufacturers and end-users.

Regional Analysis and Insights

The North American aromatic compounds market is primarily driven by the United States, with substantial demand from industries such as petrochemicals, pharmaceuticals, and automotive manufacturing. Canada is also an important player, focusing on sustainable practices and advanced production technologies to meet domestic demand. The demand in Mexico is gradually rising as the country strengthens its manufacturing sector and becomes an important part of North America’s supply chain. The region's extensive industrial infrastructure and robust regulatory frameworks create a conducive environment for growth, while access to advanced technology and skilled labor enhances production capabilities.

Opportunities and Challenges

Opportunities:

- Innovation in Green Chemistry: The rising demand for eco-friendly products provides an opportunity for manufacturers to develop bio-based aromatic compounds, attracting industries focused on sustainability.

- Growth in Pharmaceuticals: With increased investment in healthcare and pharmaceuticals, aromatic compounds present growth opportunities, particularly in drug development and manufacturing.

Challenges:

- Regulatory Compliance: Complying with environmental and safety regulations poses a challenge for manufacturers, particularly as standards become more stringent.

- Supply Chain Disruptions: Fluctuations in the availability of raw materials, exacerbated by geopolitical factors, create supply chain challenges that affect production and pricing stability.

Top Impacting Factors

- Technological Innovations: Advancements in production technology improve process efficiency and reduce emissions, making aromatic compounds more sustainable.

- Environmental Regulations: Strict regulations impact the production and usage of aromatic compounds, requiring manufacturers to invest in compliance and sustainability measures.

- Consumer Demand for Eco-Friendly Products: As consumers and industries seek eco-friendly solutions, the shift towards bio-based aromatic compounds is expected to influence market dynamics positively.

Major Key Players

Key players in the North America aromatic compounds market include:

- ExxonMobil Corporation

- BASF SE

- Chevron Phillips Chemical Company

- Honeywell International Inc.

- Dow Chemical Company

- Shell Chemicals

- LyondellBasell Industries

- SABIC

- Eastman Chemical Company

- Huntsman Corporation

Market Outlook

The North America aromatic compounds market is expected to witness steady growth driven by high demand across petrochemical, healthcare, and specialty chemical sectors. With a CAGR of 4.7% anticipated from 2024 to 2032, the market’s future looks promising, particularly with rising adoption in pharmaceutical and plastic applications. Positioned within Chemicals and Materials and Specialty and Fine Chemicals, aromatic compounds are set to remain essential across industries.

Industry Analysis and News

Recent developments in the aromatic compounds market reflect a focus on sustainability, with companies exploring bio-based and recyclable options. Innovations in production technology, such as using advanced catalysts and energy-efficient processes, are also making headlines. Major companies are forming strategic partnerships to enhance supply chain stability and research, ensuring they meet the market’s evolving demands. Additionally, investments in safety measures and regulatory compliance are creating a more robust market environment.

Scope and Future Prospects

The scope of the North America aromatic compounds market extends across multiple industries, with significant growth potential in pharmaceuticals, plastics, and specialty chemicals. As the market increasingly emphasizes eco-friendly alternatives and sustainability, there is substantial scope for bio-based aromatics and green chemistry innovations. Moreover, with continued advancements in technology and product diversification, the market is positioned for steady expansion, presenting new opportunities for both established players and new entrants.

The North America aromatic compounds market, valued at USD 55.2 billion in 2023, is projected to reach USD 83.8 billion by 2032, supported by a 4.7% CAGR. Key growth drivers include demand from petrochemical, healthcare, and specialty chemical industries, along with advancements in technology and sustainability. Positioned under Chemicals and Materials and Specialty and Fine Chemicals, aromatic compounds will continue to be vital across sectors. With ongoing innovation and increasing demand for green alternatives, the market is set to meet the needs of a rapidly evolving industry landscape.